Table of Content

According to a 2022 Clever Data Center survey of 1,000 homeowners, over one-third of buyers believed their agent could out-negotiate a FSBO seller. Buyers in many markets have limited options, due to low inventory and fierce competition for the few available homes. If buyers have worked their way through all current available homes , they're likely to reconsider homes they initially dismissed. This is why keeping track of potential buyers is a good idea as a FSBO seller.

To get an idea of how much you need to save, research the real estate market in your area. Get an idea of the cost of houses similar to ones you would like to purchase and use that number to calculate the down payment you’re looking at. (For example, Dallas homes tend to sell for a median price of $410,000.) Down payments vary among loans, so shop around to see which one is right for your situation and what percentage you need to put down. This is especially important when you're selling FSBO, since you may have a tougher time marketing your home, resulting in a smaller pool of buyers. Plus, some buyer's agents don't want to show FSBO homes because they've had bad experience with agentless sellers in the past. Keeping track of any serious, potential buyers can work in your favor.

Agentur

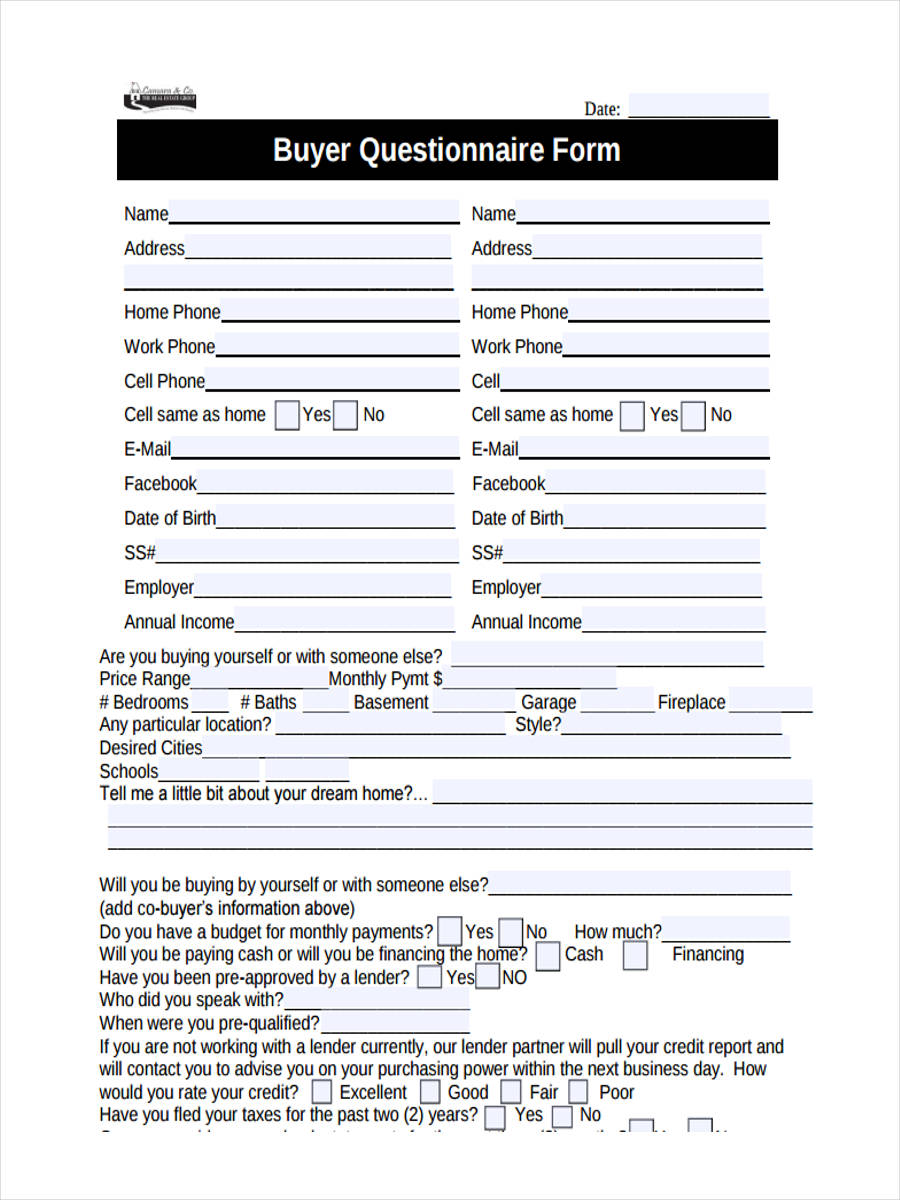

One of the best ways you can keep in touch with prospective buyers is by creating an open house sign-in sheet. That way, you can log each prospective buyer's contact info and reach out later. Make sure you talk about this point with your realtor, as they will certainly know the area as well as you do. Also, find out whether potential buyers plan todrive to work or take public transportationas this will impact their commuting experience quite a bit. You can highlight neat shortcuts or other ways to make any potential commute more pleasant and less time-consuming. However, your prospective buyers might be ready to accept some level of structural dampness if it can be fixed easily and if you are open about it from the start.

Research from Collateral Analytics, a real estate analytic product company, found that FSBO homes sell for about 5.5% less than comparable agented homes. That difference more than wipes out the 2.5–3% seller's agent commission. According to the Consumer Financial Protection Bureau, most lenders want your DTI to be 43 percent or less. If your expenses are sitting at or around 43 percent, you’ll need to trim your expenses to qualify for a loan.

PROSPECTIVE HOME BUYERS & RENTERS

During this day-long class, attendees hear from lenders, real estate agents, home inspectors and others involved in the purchase transaction. This class is required as a condition of qualifying for certain types of mortgage loans. Three in every five prospective buyers reported having already hired an agent.

The survey shows nearly half (46%) of prospective buyers who submitted applications for mortgage pre-approval only submitted one application. Zillow research finds prospective home buyers who don't shop around could end up spending tens of thousands of dollars more over the course of their mortgage. Zillowresearchfinds prospective home buyers who don't shop around could end up spending tens of thousands of dollars more over the course of their mortgage. According to the survey, 28% of prospective buyers spent at least a month researching vehicles for their next car purchase, but only 13% said they spent that much time researching mortgage lenders before applying. Twenty three percent of prospective buyers spent at least a month researching their vacation options before booking, and 12% spent at least a month researching a new TV before purchasing.

Prospective buyers report more use of low-tech search tools

Some people are not the biggest cat or dog lovers, and that’s okay. If you have a pet, try to ensure they are not on the premises when you are showing the home. People can be put off by an eager dog greeting them as they come in or a curious cat wanting to say hello. Of course, there are people who will love to be greeted by an animal, but you never can tell, so it’s better to be on the safe side. Don’t be offended when we say that your home might smell in an unpleasant way without you being aware of it.

Another Zillow survey found that 86% of sellers prefer a buyer who has been pre-approved, as opposed to pre-qualified, for a mortgage. Pre-approval includes the financial history that are requested during pre-qualification, but usually also requires documentation to support the information provided and a credit check. The financial check provided by pre-approval can give sellers more certainty that a buyer will close on time, and it allows buyers to make a stronger, faster offer the minute the right home hits the market.

Sign up for our mailing list and receive the latest reports

The information contained on this website is intended as an overview on subjects related to the practice of law. Each individual case is different, and laws do change, so please be aware that the circumstances and outcomes described may not apply to all cases and should not be interpreted as legal counsel. Please seek the advice of an attorney before making any decision related to legal issues. Not being patient enough to see the results of what they have done. Take a step back and let the results of the fast hard rate increases take it’s toll. Meds take time to show results but too many meds too fast cause an overdose.

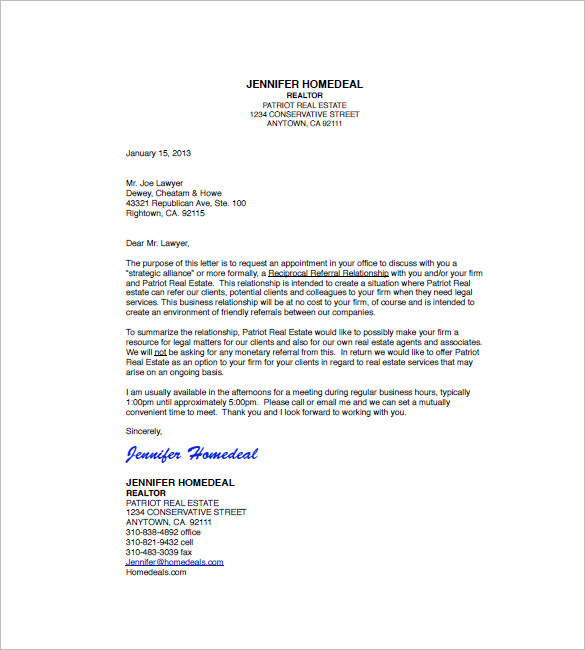

Although specific point estimates changed with this alternative approach, the substantive trends did not differ. In order to gain a comprehensive understanding of U.S. prospective buyers, Zillow Group Population Science conducted a nationally representative survey of more than 7,100 prospective buyers. Seventy two percent of prospective home buyers have not shopped around for, nor have any plans to shop around for, their mortgage. Remember a Real Estate Agent representing a seller is legally required to act in the seller's best interests. The agent wants to realize the highest selling price in behalf of his Client. Also, the agent's income is usually a commission calculated as a percentage of the selling price, so the more money the Agent gets the Buyer to pay for the house, the more commission the Agent gets paid.

But while these large-scale changes have shifted the landscape and have the potential to reshape buyers’ preferences over the longer term, many behaviors and attitudes remain the same. Home buyers who don't shop around could end up spending tens of thousands of dollars more over the course of their mortgage. As Investopedia explains, two of the most popular approaches to paying off debt include the snowball and avalanche techniques.

Of course, you need to call us and not the listing agent to see the property. ") Home Buyer’s Perspective Realty is paid the same regardless of how much or how little the home’s final purchase price. If you aren't getting enough offers, you may want to reach out to those who have toured your home — these buyers are the best source of feedback you can find. The idea here is to encourage additional offers and spark a bidding war. Buyers who are on the fence may feel like they should bid if they're having a tough time finding other homes. But if a buyer tours your home and doesn't make an offer, don't count them out just yet — they can still be a potential buyer.

No comments:

Post a Comment